With over $70M in assets in Alberta – and a 15+ year stellar track record there – we have been asked this a lot lately: what about oil, the NDP and Alberta real estate ? Will hell freeze over ? Is orange crush a drink, or an economic impact statement ? Will you sell all assets ? Will you buy more ? Will you buy differently ?

In short: Think Ontario, with oil ! Did Ontario see real estate value or rents drop ? No, quite the contrary under the spend, spend, spend crazy Liberals in Ontario the last 6-7 years. While oil might not go up well beyond $70 for a while, it may hover in the US $55-$65 range for some time, enough for many projects to be profitable AND for output volume to increase. US$60 oil is Can $75 .. and soon Can$80 with the recent interest rate cut in Canada and expected rise in the US, only roughly 25% lower than in 2014 in Can $s. A much under-reported fact and not nearly as bleak as the media likes to make it.

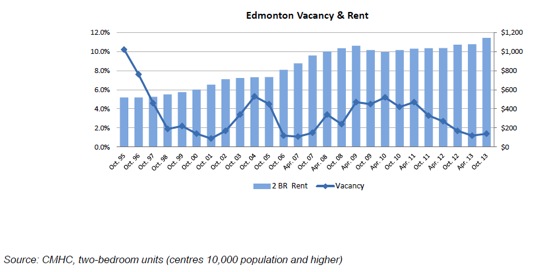

The major impact will be somewhat lower net wages, less overtime $s for out-of-province oil workers in far away oil sands or rig projects, and far less money for all those now laid off non-Albertans flying in every 2 weeks from Nanaimo, Kelowna, Halifax, Nfld .. and that is why we have NOT seen rents drop nor vacancies go up, nor house prices move in more diversified cities like Edmonton. Even Calgary has seen at best 2-3% price drop on the high end, with bidding wars and multiple offers not unusual again on beginner and average homes.

What about rental properties?

Here is a 20 year view on Edmonton rents and vacancies:

Alberta will always have oil & gas royalties, over and above any province without oil. But yes, they need to tighten their spending belt (ain’t gonna happen with the NDP, that is for sure) and higher taxes, ideally a PST (ain’t gonna happen either). That leaves higher corporate taxes, higher royalties and higher income taxes, and of course: more debt.

Already very well paid teachers, nurses, doctors and civil servants, and the under $15/h crowd cheer, with wage increases, while the wealth creators in the private sector get stiffed in the classic Robin Hood maneuver. The result of this dropping private investment: a sea of red ink will be unleashed disguised as “investments” into healthcare, education, innovation and diversification leaving Alberta with well over $20B to $30B in debt by 2019, for future politicians and tax payers to clean up. However, much like in Ontario, this will be an enormous stimulus for the province .. and positive for rental properties !

What may grab your attention is that the asset class we operate in, residential RENTAL properties, will provide far safer cash-flow in good times and in bad.

Ensure that you are always looking at a return OF your capital before a return ON your capital.

Many projects which show a high return on paper have substantial risk. Risk is often overlooked in investments. The asset class we operate in is fairly safe, far safer than construction projects – many of which will be halted in AB – or commercial or industrial properties which will see substantial vacancies over the next few years. Contrast that to residential rental properties which will be in HIGH DEMAND as “would-be buyers” wait for price corrections and rent instead.

We successfully operated through such a market correction in 2008-2009 where many real estate syndicators went out of business while our assets continued to perform. The risk-adjusted return in our asset class is excellent for investors seeking safety of principal and a decent yield. Construction projects, hotels, industrial buildings, commercial projects are at substantial risk as of Orange Tuesday May 5, the day of the NDP election, in Alberta – as opposed to rental properties.

Please feel free to call or email us if this is of interest to you, or check here why do we continue to invest in rental properties, such as mobile home parks or apartment buildings for a total KINGS CASTLE LP gross asset value of approximately $25M with a decent 7-10% target ROI in a low-risk asset class (please see legal disclaimer on risk in link)

The sky is falling .. who will shut off the lights?? Not. We expect oil prices to rise again later in 2015 for continued growth in jobs, tax revenues and GDP. 2015 is a good year to own rental properties and collect rent monthly and pay down your mortgage. It certainly won’t be as rosy as in 2011-2014, but will be OK after year-end. Alberta might even curtail its excessive public sector spending vs. its tax revenue. [oops, maybe I was just dreaming ..]

Initial very negative expectations about the NDP (incl. by me) were not followed yet by as drastic actions as expected. For example, the NDP didn’t institute rent control as was widely expected and Rachel Notley is actively working with other provinces, incl. Quebec for an east-west pipeline (see here) and promoting the evil “tarsands” even, by using the term oilsands and giving up-beat investment speechees (see actual pro-oilsands speech delivered at the Calgary Stampede here). Of course, we all wished we had a Premier more like Brad Wall that actually believes in what he says, as opposed to tepid words only (see here). But, at least she is not drawing any lines in the oilsands with her new Premier colleagues in St. John’s this week culminting in a new national energy strategy. More on this here.

So, yes, the market will slow down for a year, perhaps two, but if you take the long view it is a great province to invest or live in. Edmonton is still running strong with over $2.5B invested in its city core around the arena plus new LRT lines, airport expansion and Anthony Henday ring road completion for mid 2016. Calgary for that reason had no apartment buildings for sale at all in the first half of 2014 as they are all performing so well, but assets can be found in Edmonton or Red Deer; now for realistic prices even .. no bargains yet though in the rental universe.

-> A great place to STILL own assets with perpetual rental income, but one has to be a far more careful buyer until oil picks up and NDP policies (on royalties, regulations and spending) are more concrete, say until later in 2016.

While unemployment has gone up, it is STILL below the Canadian average as per these stats, says ATB chief economist Hirsch. “Even with the jump in June, only 2.1 per cent of workers in Alberta are collecting benefits, below the national average of 2.8 per cent and on par with the other three western provinces. Only Ontario has a slightly lower rate (2.0 per cent).” More on this here: http://calgaryherald.com/storyline/the-number-of-albertans-on-ei-is-soaring

As Canadians we are far far better off than most if not all industrialized nations. We are one of the, if not THE wealthiest middle class: http://www.theglobeandmail.com/report-on-business/top-business-stories/canadas-middle-class-now-worlds-richest-study-suggests/article18090490/

Sincerely + Successful Investing,

Thomas Beyer President

Prestigious Properties Group

T: (403) 678-3330

www.prestprop.com