Many investors are looking for a decent yield beyond the sub 1% available in the government or the 2-3% in the corporate bond market.

After some research they usually stumble upon MICs. Wow, they say, some yield 6% or even 9%. Let’s buy some. Not so fast I’d say.

How do you evaluate a Mortgage Investment Corporation (MIC) that by law is required to pay most of its profit to investors on a monthly, quarterly or at least annual basis ?

Public vs. Private MICs:

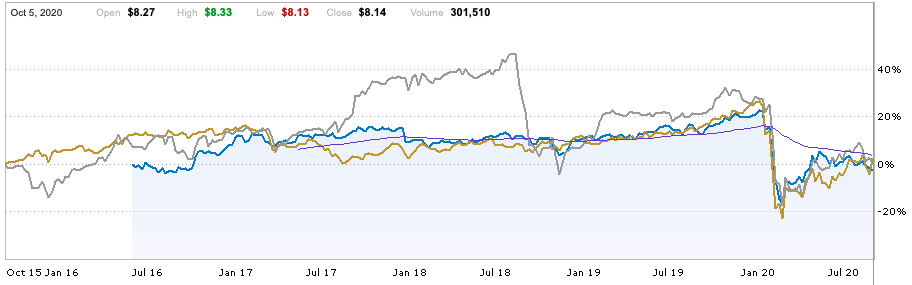

First of all there are two types of MICs: Those that are Publicly Traded, and those that are Private. Of the publicly traded ones, three fairly large ones are Timbercreek Financial (trading symbol TF, in blue), MCAN Mortgage Corp. (MKP, in grey) and Firm Capital Mortgage Investments (FC, in yellow). They all yield around 6% depending on the price you buy them. Below is a 5 year chart, from October 2015 to October 2020. What you see is that most of them have initially risen a little or are flat, then fallen in price during Covid like most stocks then recovered but still below pre-Covid levels.

Thus, you get the same volatility as a dividend paying stock, more or less, but with a slightly higher yield as they do not have an active business.

Lending their money is their business. So, you collected ~6%/year in yield, before taxes btw, but now the stock is 10-15% lower. Are you any further ahead ? Obviously not, as the yield barely made up for the price decline. Will they fall further as interest rates rise somewhat over the next few years ? Or will they stabilize and provide a good perpetual income ? Read on, as the analysis is the same compared to a non-publicly traded MIC, a private MIC.

3 publicly traded MICs – from October 2015: Timbercreek Financial (trading symbol TF, in blue), MCAN Mortgage Corp. (MKP, in grey) and Firm Capital Mortgage Investments (FC, in yellow).

Asset Type:

MICs generally invest in three types of assets:

- Income producing existing assets,

- under-performing assets being rejuvenated or

- assets that are being built, i.e. construction mortgages.

As such, you have to look at the underlying philosophy of the MIC and ask the management what they invest in, or what percentage is in either of these three asset classes, where these assets are and what maximum loan-to-value they usually lend at.

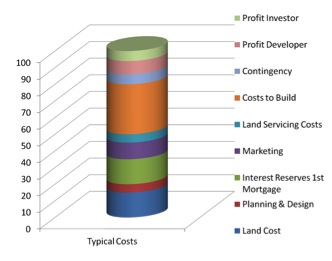

Construction projects are more risky, as the asset to be constructed does not yet exist. As such the yield ought to be higher, and usually is, if the project is executed on plan. It is per se not a bad investment, but it is highly dependent on the quality of the builder and the demand for the product being built. As you can see from the graph below, in a typical construction project of say a high-rise tower or a mid-rise condo building, hard construction costs make up only about 35-40% of the actual costs. There are also land acquisition costs, land servicing costs, planning, permitting and design costs, sales & marketing costs, contingencies and interest reserves for the first mortgage lender, as the MIC is often in second position.

As we have seen from the spectacular failure of Fortress where over $900M got “lost” (see here or here or here ) construction mortgages can be very risky as they are sometimes not in first position or the “value” in loan-to-value is not the current “as is” value but the future “to be built” value. Fortress raised a lot of money and the mortgages “secured on real estate” often exceeded by a wide wide margin the actual current value of the acquired land plus some servicing or marketing costs. As such, check the fine print and ask a lot of questions. Many private MICs, such as this private MIC in North-Vancouver, BC called Dundarave MIC run a solid business with well researched projects [ I used them for the Oliver Landing project to borrow about $2M successfully in the lower double digit range]. MICs are generally TFSA and RRSP eligible so it is a great way to get 5-10% yields (or sometimes more) tax free !

1st or 2nd Position ?

Mortgages on assets have priorities. As such you have to understand the position the MIC is in: in first position, or in second (or worse: in third). If the MIC is not in first position it means that on a severe construction delay, market change or slow condo sales process only the first mortgage lender gets possession of the asset, leaving the second lender with nothing in many cases. As you can see above, the profit room to pay developer, investor and/or MIC is often very small, sub 20% in total in many cases and that means that construction delays or a drop in sales price by only perhaps 10 or 15% immediately impacts the developer, the investor or MIC. If the MIC is the investor in second position, or even in first, there is severe risk that not all principal invested can be paid back, let alone the agreed upon interest. As such, you have to look at the underlying asset quality, the operator and the location very very carefully in a construction MIC, or a MIC that invests mainly in construction. A look at their track record helps, such as the default ratio in the 2008-2009 or Covid spring to summer 2020 recession that saw many foreclosures not only in the US but also in Canada.

Keep in mind that your upside, say 8% or 12% is capped, but your downside might still be 100%, unlike a direct ownership of the underlying real estate.

If the MIC is not in first position, you have to understand the loan-to-value (LTV) of the first mortgage and its interest rate. If the interest rate on the first mortgage is above current commercial terms (say 2.5% to 3.5% on an apartment building, 3.5-4.5% on a quality industrial or commercial asset, or 6-8% on a hotel) you have a high risk project and your MIC money is at risk, too. Of interest is the LTV of the first mortgage. If 50% or lower, the MIC in second position might still yield the target return if the operator / borrower executes as planned, as the MIC usually does not want to take over the asset in a semi-finished state or on a distressed sale.

OK, what about MICs with money only in first position ? Well, first of all this is far safer, but you will see far lower yields. CareVest, one of the premier MICs in Canada currently (who I also used as a borrower around 2003 when I bought an asset in Red Deer) has two MICs, one with mortgages in first positions which yields around 5-6%, and one in second position yield 8-9%+. You decide what risk you wish to take. One MIC I know of lends only to large commercial operators and never over 60% LTV. The MIC yields 3% or so, basically what you can get in a commercial grade corporate bond, too – and that is what I would expect as the risk is similar.

Some MICs lend on distressed or turnaround assets, but only in first position. Some lend on single family homes in second position while the borrower is awaiting approval on a first to pay them out. Others have built a niche in certain markets or certain assets types, say distressed hotels, trailer parks in rural areas or defunct resorts. In all of these cases it is important to look at the track record of the lender, in bad times, say 2008-2009 or during Covid in spring to summer 2020, as some of these MICs are decent performers despite the risk they take on.

Cash-Flow vs. Net Income

Then, if you have a portfolio of projects in a large MIC, look at the statement of cash-flow, as it shows net cash-flow vs. the accounting income. Often the net income is higher as some of the interest is accrued, but not collected in cash. This takes a bit of math or accounting skills, as some MICs lend money and insist on a monthly payment from the borrower, while others, typically in construction projects, allow accruing of interest, which is income, but not cash. The more accrued income you see on the balance sheet the more risk the MIC has taken. The projects might still pay out, possibly through a foreclosure of the underlying asset, so this is hard to gauge without detailed project-by-project updates.

There you have it: Four criteria for How to Evaluate a MIC

Much like REITs, a higher yielding MIC usually is a riskier one. Ensure that you do not blindly follow just the marketing brochures, but also look at the quarterly or annual financials, and you can get a decent 4-7% yield with low to modest risks, or one with juicier yields but substantial risk in the high single to low double digit range.

As always, look not only at a return on your capital, but also at a return of your capital !

Thomas Beyer, President

Prestigious Properties Canada Ltd.