When you buy and operate income producing real estate, what is the highest expense ? What cost item must we watch the most careful ? Is it property taxes, which we can hardly influence? Or is it utilities which we can influence to a degree through better water and gas efficiencies measures ? Or is it cost of labour, for painters, onsite managers or cleaners ? While these cost items are important and are carefully managed by us, it is the cost of money that is most crucial for any real estate investor.

You need money to buy real estate. Lots of it. A smaller portion, say 20-35% is invested cash, or equity, but 65-80% is usually borrowed. As such the price of money is vital.

Right now, money is on sale. Interest rates, the price of money, are very low. It has to go up in time, is the common wisdom. But is this actually true ?

Here are seven reasons why I believe interest rates will stay low low LOW for a long LONG time:

- If you lend money to the US or Canadian government for 5 years they both will pay you less than 1%/year. Do you think that lenders would lend them money for 5 years at sub one percent if they thought rates would go up in 3 years ?

- What about 10 year bonds ? Both Canadian and US bonds are sub 2% as of early February 2015. Do you think that lenders would lend them money for 10 years at sub two percent if they thought rates would go up in 6 years ?

- What about even longer, say 30 years ? 30 year US treasuries yield 2.34% as of Feb. 4 2015. If the US government borrows money it pays you 2.34% per year, for thirty years, and then pays you back your initial investment. Is this an indication that rates will go up soon ? Do you think that lenders would lend them money for 30 years at sub 2.5% percent if they thought rates would go up substantially in 18 years ?

- A 30 year mortgage is not common in Canada but it is still common in the US. What does an average home owner pay for a 30 year mortgage ? Sub 3.5% ! Why would PhD studded banks lend money at sub 3.5% for 30 years if they thought rates would go up, say to 5% in ten years or to 8% in 18 ?

- China’s, Europe’s, Japan’s and Canada’s non-immigration population are growing quite slowly or are already negative, i.e. more people die than are born by local mothers. Japan and Europe overall have a negative population growth rate. In the developed world, only the US has a natural growth rate of over 2 babies per female, primarily due to its large Hispanic population. The US, UK, Australia and Canada have decent population growth due to immigration. China’s population is expected to decline by 2050, and Europe is already declining if it were not for immigrants. Germany, where I originally hail from, is expected to shrink from over 80M people to under 60M in 30 years and is now discussing immigration incentives and even higher incentives for child raising.

- Many central banks offer very low or negative interest rates, primarily to stimulate local growth but also to keep their nation’s currency low in a “race to the bottom” of one currency vs. another: ECB and Japan are below 0, Denmark and Switzerland are now at -0.75%, Japan has been this low for almost 20 years now due to its aging population. Canada’s central bank rate is now at 0.75% and is expected to drop it to 0.5% sometime this summer if oil doesn’t rise substantially, say over $60. UK’s is at 0.5% and the US is at 0.25%.

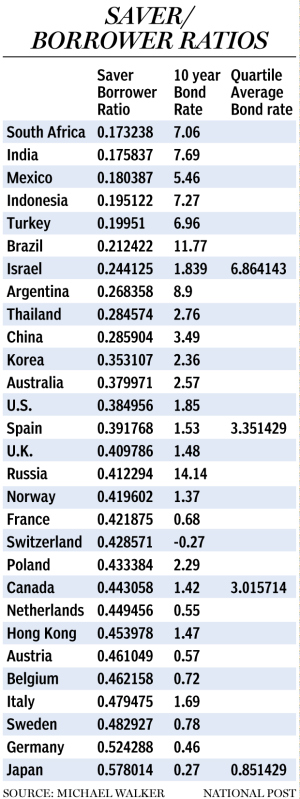

- Interest rates are low in countries with a high ratio of aging people vs. fast spending, economy stimulating young people in their 20’s to late 40’s. This is referred to as the “natural interest rate”. Look at this graph here on the right, which shows that aging countries have very low interest rates. The creator of this chart, Michael Walker, defines this saver/borrower ratio as the ratio of people between 50 and 74 over the people between 0 and 49. The more savers vs

. borrowers, the lower the natural interest rate for that nation. Younger people, say up to 50, are naturally borrowers as they buy a car every few years, a new or a bigger home, new strollers, a second car, kids’ clothing, new bikes, ski helmets etc. whereas older people are generally savers i.e. downsize from a bigger home to a smaller home, use their skis longer or never buy new ones, spend more on vacations and/or have larger bank or RRSP accounts usually, but are also more cautious. Many countries, Canada included, are awash in savers, also referred to as baby boomers, for the next 20-30 years ! This chart also explains why interest rates in some countries, like Japan or Germany are even lower than here in Canada, and why rates in the US, for example, should naturally be somewhat higher than here, which they are today and are expected to be in the foreseeable future.

. borrowers, the lower the natural interest rate for that nation. Younger people, say up to 50, are naturally borrowers as they buy a car every few years, a new or a bigger home, new strollers, a second car, kids’ clothing, new bikes, ski helmets etc. whereas older people are generally savers i.e. downsize from a bigger home to a smaller home, use their skis longer or never buy new ones, spend more on vacations and/or have larger bank or RRSP accounts usually, but are also more cautious. Many countries, Canada included, are awash in savers, also referred to as baby boomers, for the next 20-30 years ! This chart also explains why interest rates in some countries, like Japan or Germany are even lower than here in Canada, and why rates in the US, for example, should naturally be somewhat higher than here, which they are today and are expected to be in the foreseeable future.

I conclude: Interest rates in neither Canada nor the US will go up soon, likely for 20+ years. And if the US raises their federal fund rates from a too low 0.25% by 0.25% or 0.5% ours will not follow. As such, the loonie might drop a bit further still if that happens.

Money is on sale.

If something is on sale, you generally use more of it, not less. As such, don’t complain that you don’t get more than 1 or 1.25% from your local bank if you lend them money. Go there, and borrow some more, and buy some decent yielding, high demand, non-volatile, impeccably managed, income producing real asset, such as a townhouse, a single family home with a basement suite, an apartment building, a mobile home park, a small retail mall or any other well located and impeccably managed commercial real estate. If this is too much work for you, invest with a reputable and experienced real estate firm (such as ours) or perhaps buy a publicly traded (albeit far more volatile) REIT, or shares in a pipeline, resource royalty or utility company.

Borrowing at 2.5% to 4% and investing it in assets that yield 5-9% makes total sense to me and is the base for my personal but also PrestProp’s wealth creation strategy. More information on general investment ideas and principles in in our Investment Strategy Blog, such as “Real estate is like a three course meal“, “How to evaluate a MIC” or “How to successfully invest in REITs or private real estate syndications”.

Don’t believe all the uninformed naysayers that tell you “rates will go up .. rates will go up”. Look at the real world instead and what is happening to interest rates, here, in the US or elsewhere. They will stay very very low .. for a long long time !

Use this knowledge to your and your family’s investment advantage!

To your success !

Thomas Beyer, President

Prestigious Properties Group